In the ever-evolving landscape of manufacturing, stamped metal parts play a crucial role across various industries, including automotive, aerospace, and electronics. As we step into 2023, understanding the latest statistics surrounding these components becomes imperative for businesses aiming to stay competitive. This year, we delve into the top 10 stamped metal parts statistics that provide valuable insights into market trends, production efficiency, and technological advancements.

The increasing demand for precision-engineered products and the push towards sustainable manufacturing solutions have further highlighted the importance of stamped metal parts in modern production processes. As companies strive to optimize their operations, embracing data-driven strategies and staying informed about industry benchmarks can lead to significant improvements in productivity and cost-effectiveness.

With an eye on the future, this article not only presents the critical statistics but also explores the implications for 2025 and beyond. By harnessing this knowledge, stakeholders can make informed decisions that enhance their capabilities and drive innovation in the manufacturing of stamped metal parts.

The demand for stamped metal parts is on the rise in 2023, driven by advancements across various industries including automotive, aerospace, and electronics. With the growing complexity of designs, manufacturers are increasingly turning to stamped metal parts due to their cost-effectiveness and durability. This trend highlights the importance of efficient production methods that can meet the escalating demand without compromising quality.

According to recent market projections, the global metal fabrication equipment market is expected to grow significantly, increasing from $64.64 billion in 2025 to $82.78 billion by 2032, with a compound annual growth rate (CAGR) of 3.6%. This growth trajectory underlines the pressing need for enhanced manufacturing capabilities as sectors continue to embrace stamped metal technology. As industries evolve, the versatility of stamped metal parts will be crucial in addressing the challenges of modern production while supporting sustainability initiatives through more efficient use of materials.

In 2023, several key industries are driving the demand for stamped metal parts, highlighting their crucial role in modern manufacturing processes. The automotive industry remains a significant player, as vehicle manufacturers increasingly rely on precision-stamped components for various applications, from structural frames to intricate interior fixtures. Innovations in electric vehicle technology also demand new stamped designs, enhancing robustness while minimizing weight for improved efficiency.

The aerospace sector is another vital contributor, where stamped metal parts are essential for creating lightweight yet durable components that meet rigorous safety standards. Specialized stamping techniques are employed to produce parts that can withstand the extreme conditions of flight while adhering to tight tolerances. Additionally, the consumer electronics industry has begun to utilize stamped metal parts for housings and internal structures, capitalizing on their strength and aesthetic appeal.

As technology advances and industries evolve, the relevance of stamped metal parts continues to expand, reflecting broader trends toward automation and efficiency in manufacturing.

In 2023, the landscape of stamped metal manufacturing is witnessing varied growth trends across countries, with specific regions showing significant advancements. The European Union's stamping foil market, for instance, is anticipated to experience modest growth, projecting a volume compound annual growth rate (CAGR) of +0.9% from 2024 to 2035. This trend reflects a cautious but steady demand in traditional manufacturing sectors, underscoring the EU's critical role in the global stamping foil market.

Simultaneously, countries heavily invested in metal stamping are preparing for broader transformations as the global metal stamping market revenue is expected to soar to around USD 312.32 billion by 2033, up from USD 223.68 billion in 2025. This growth signals a robust increase in demand, driven by advancements in manufacturing technologies and rising needs across various industries. As the competition intensifies, nations will need to enhance their production capabilities and manage costs effectively to maintain their competitive stance in a rapidly evolving market landscape.

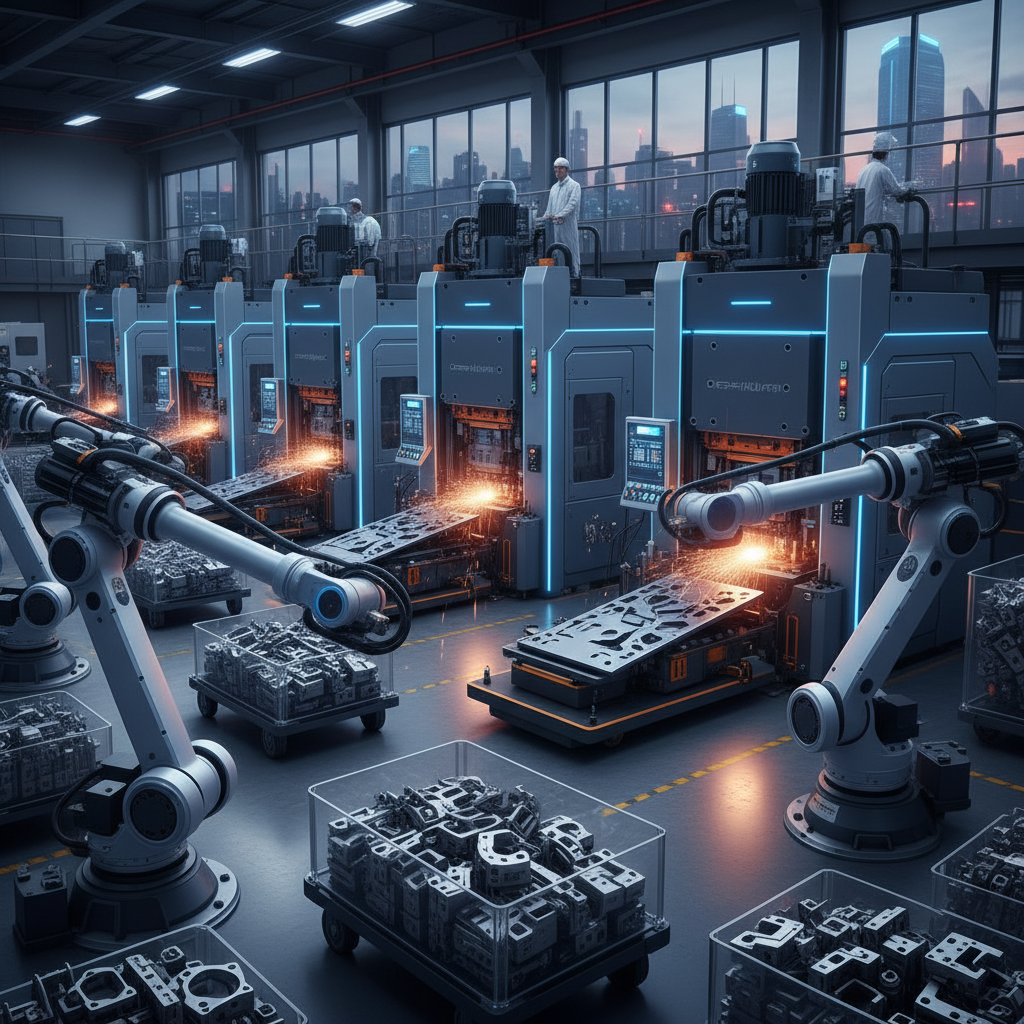

Innovative technologies are revolutionizing the stamped metal production industry in 2023, introducing new efficiencies and enhancing product quality. One of the most significant advancements is the integration of automation and robotics in manufacturing processes. Automated stamping presses not only increase production speed but also improve precision, minimizing defects and reducing waste. The use of robotic arms for material handling and part assembly streamlines operations, allowing manufacturers to meet the increasing demand for complex metal parts in various industries, from automotive to aerospace.

In addition to automation, the rise of digital tools such as artificial intelligence (AI) and the Internet of Things (IoT) is transforming how manufacturers approach design and production. AI algorithms can optimize stamping processes by analyzing data to predict failures and identify areas for improvement. Meanwhile, IoT-enabled machines provide real-time monitoring and feedback, facilitating proactive maintenance and enhancing overall productivity. These technological advancements not only enhance manufacturing capabilities but also pave the way for more sustainable practices, minimizing energy consumption and resource use in stamped metal production.

| Rank | Statistic | Value | Year |

|---|---|---|---|

| 1 | Global Stamped Metal Parts Market Size | $73 Billion | 2023 |

| 2 | Annual Growth Rate (CAGR) | 4.5% | 2023-2028 |

| 3 | Percentage of Automotive Sector | 60% | 2023 |

| 4 | Prefabricated Metal Capacity Increase | 15% | 2023 |

| 5 | Use of Automation in Stamping | 30% | 2023 |

| 6 | Steel's Share in Stamping Materials | 70% | 2023 |

| 7 | Aluminum Component Use Growth | 25% | 2023 |

| 8 | Environmental Impact Initiatives | 80% | 2023 |

| 9 | Investment in Advanced Technologies | $5 Billion | 2023 |

| 10 | Emerging Markets Growth Rate | 6.5% | 2023 |

In 2023, the metal stamping industry is witnessing significant shifts towards enhanced cost-efficiency and sustainability. According to a recent report by MarketsandMarkets, the global metal stamping market is projected to reach $230 billion by 2026, growing at a CAGR of 5.2%. This growth is largely driven by the automotive and aerospace sectors, which are increasingly prioritizing stamped parts for their reliability and cost advantages. Notably, the adoption of advanced technologies such as automation and AI in metal stamping processes is reducing material waste and optimizing production efficiency.

Sustainability is becoming a critical focus for manufacturers, with many companies reporting a 30% reduction in energy consumption through the implementation of eco-friendly practices. A study conducted by the Metal Forming Institute indicates that over 65% of stamped metal parts are now being recycled, contributing to a circular economy. By utilizing recyclable materials and investing in energy-efficient machinery, companies are not only lowering their production costs but also minimizing their environmental footprint. As the industry moves forward, balancing these dual priorities of cost-efficiency and sustainability will be essential for long-term success.

You are using an outdated browser. Things may not appear as intended. We recommend updating your browser to the latest version.

Close